European Expansion: Why Top US Companies Accelerate While Others Retreat

Lessons from 200+ US B2B Software Startups

Over the past 18 months, we’ve shifted from an era of ‘growth-at-all-costs’ to one of ‘efficient growth’ as purse strings tighten. Against this backdrop, it can be tempting for US CEOs to deprioritize European expansion out of fear of the unknown.

This would be a mistake. And a costly one at that.

Because expansion involves importing a proven product and GTM motion from the US, it’s actually lower risk than other growth levers available to CEOs - namely, expanding into new products (which requires building brand new features and determining how to sell them) or new customer segments (which requires a whole new GTM motion).

Last week, at Frontline, we released our 2023 European Expansion Report, where my colleagues analyzed the expansion journeys of 200+ US B2B software startups into Europe.

In case you missed it, here are the 5 key data points you likely didn’t know about European expansion .. and reasons why you should read the full report:

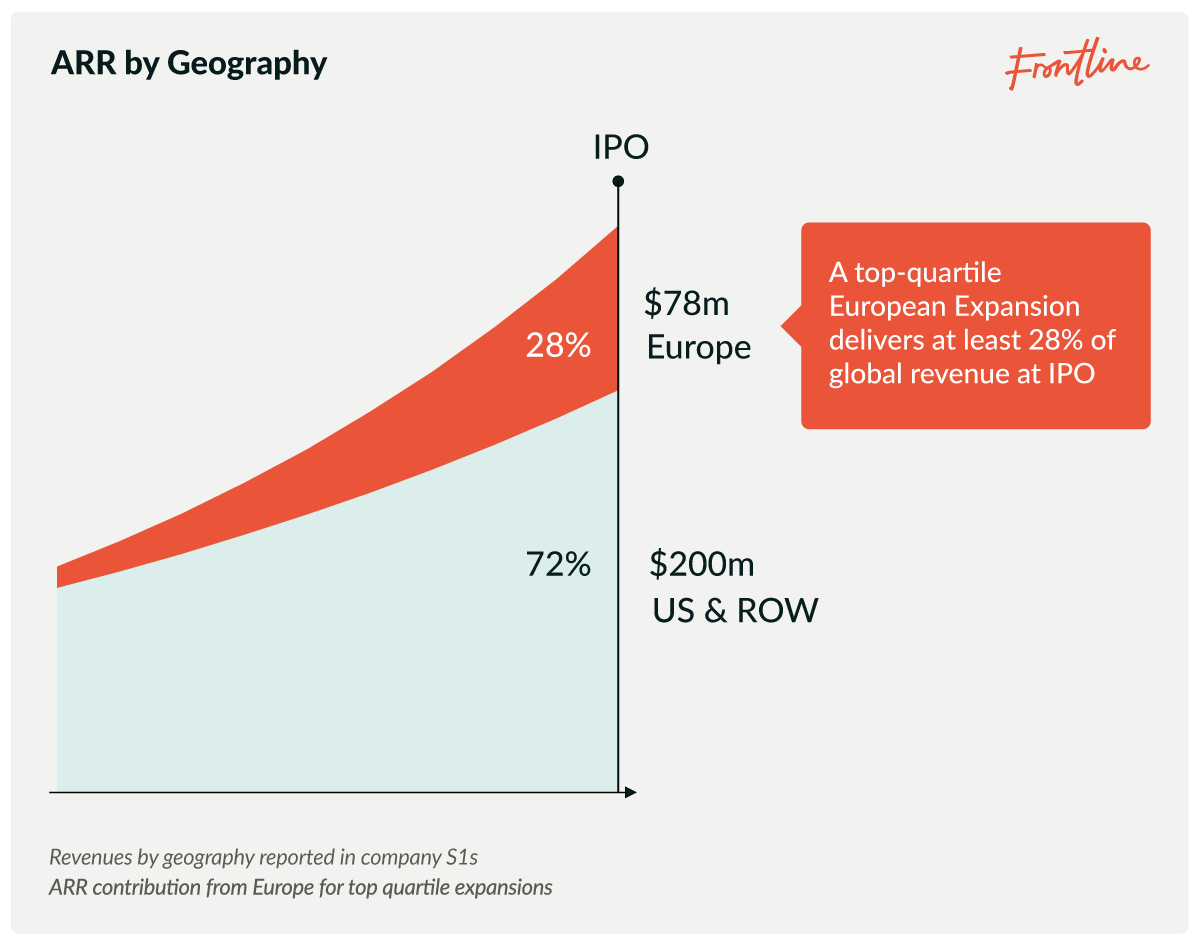

1. Europe accounts for up to 40% of global revenues for top performing US companies at IPO

The market opportunity in Europe is far larger than most US CEOs appreciate.

For category-leading companies, it represents a huge contribution to total revenue - with top-quartile companies reaching at least 28%, and the most successful companies generating over 40%, of their global revenue from Europe by the time they go public.

To put that into perspective, that’s around $80m ARR for a typical company going public today.

In the years leading up to IPO, it’s common for US growth rates to taper off whilst Europe offers a revenue stream with higher-growth potential. European expansion therefore proves a critical lever for improving companies’ growth endurance.

2. Most US companies fail to capture this value

Despite the potential upside from Europe, companies arrive at IPO with vastly different shapes to their European business. Across the 200+ companies analyzed, Europe’s contribution to global revenue varied dramatically.

A poorly executed expansion means foregoing 17% of ARR.

This gap also translates directly to Enterprise Value (EV) creation. Per S1 filings over the last 10 years, Europe provided a 31% boost in EV at IPO for the median company, while top-quartile expansions delivered a +55% lift in EV.

The variance between leaders and laggards is not surprising. Success in Europe hinges on a few pivotal decisions made early on in the expansion journey, but even the best companies fall at these initial hurdles. Some of the most common (and avoidable) mistakes we see:

Expanding too late (out of fear)

Getting the first senior hire wrong

Ramping too rapidly across European markets

Succumbing to ‘success amnesia’

3. As the European ecosystem strengthens, the consequences of delaying European expansion are heightened

The startup ecosystem in Europe has expanded at a staggering rate, and become a significant influence on expansion timing for US companies.

VC funding raised by European companies is up 10x over the past decade and the number of companies being founded in Europe now rivals that of the US.

More critically, Europe is now generating high-quality companies that surpass its previous reputation as a mere copycat factory. Led by founders with global ambitions, these companies bring novel business models and technologically unique products to the market, backed by global VCs with deep pockets. These factors combine to make the decision of when to expand to Europe more crucial than ever.

Expanding too early risks destabilizing your US business, but expanding too late leaves the door open for local competition to capture market share.

4. Getting the first senior hire right in EMEA is crucial - yet 47% of companies get it wrong

47% of EMEA General Managers depart their company within two years of joining, demonstrating just how challenging it is to source and evaluate EMEA GM candidates.

The responsibilities entrusted to the first senior hire in Europe are significant - building the team, driving revenue, seeding culture, and being the external face of the company on a range of topics. Some US CEOs have a tendency to focus on recruiting GM candidates from a select few companies with which they are familiar, however the data highlights that out of the 122 GM hires, candidates were sourced from a diverse pool of 116 companies. At Frontline, we’ve seen this diversity reflected in our community of 200+ EMEA VPs that are scaling high-growth US SaaS companies in Europe.

Limiting your candidate scope can lead to missing exceptional local talent with unique regional insight.

5. Except for the UK, top HQ locations (IE, NL) do not align with top European startup hubs (FR, DE)

A common misconception amongst US founders is that Europe’s main startup hubs are also the most popular HQ locations for US companies. However, aside from the UK, there’s actually little correlation between the two. France and Germany don’t control a large share of expansions. Instead, countries such as Ireland and the Netherlands punch above their weight.

London, Dublin and Amsterdam have always been the most popular first landing locations for US startups, and they have only extended their dominance in recent years, with 90% of expansions landing in one of those three locations — up from 57% only ten years ago. The deepening of management and executive talent pools in these locations make it increasingly hard for Berlin or Paris to break into the club.

Whilst the past few years have seen significant market volatility, with regards to European expansion, one thing remains unchanged - Europe is a critical market to crack in order to build a truly global business.

Successful expansion requires disciplined execution and experience.

If you’re a high-growth US CEO thinking about European expansion, we hope this report will be a useful reference and would love to hear from you!

great coverage, thank you!