Welcome to Archived - the chronicles of a VC attempting to decode innovation in technologies, markets and business models. If you enjoy this post, you can subscribe👇 or catch me at ruth@frontline.vc for a chat!

Dealers of Information, Sellers of Time

Services. A dirty word in venture capital circles, but the heart of the global economy. It’s an interesting dichotomy.

These unsung heroes, encompassing everything from legal and cybersecurity to design and recruitment, contribute on average 70% of the G7’s GDP1. And, although we can't paint all service providers with the same proverbial brush, they do have a shared characteristic in how they operate.

When you boil it down, most service providers are dealers of information and sellers of time.

Dealers of Information: They gather disparate (usually unstructured) inputs to understand client issues, sprinkle in some professional or technical acumen, and produce some form of information artifact (a report, transaction document etc).

Sellers of Time: Service providers sell people (in a socially acceptable way that is!), and more specifically, hours. This business model has two important implications. Firstly, inefficiency yields financial returns. A more efficient method means fewer billable hours and less revenue. Secondly, if people are your product, trust and personal relationships are the name of the game.

Massive industries spun up around these dealers of information. For context, in 2022, the Big 3 consulting firms took home a combined $29bn2 in annual revenue.

The dominance of these industries has historically hinged on humans’ unique ability to handle a high variability of unstructured data and generate bespoke, creative outputs - domains where machines once fell short.

Clients paid premiums for tasks deemed exclusive to human intelligence and creativity. A status quo that persisted unchallenged until now.

Large Language Models (LLMs) and more broadly, Multi-Modal Models, are enabling the transformation of services to AI, providing a ‘10x and cheaper’ alternative to the traditional dealers of information.

Turning Services into AI

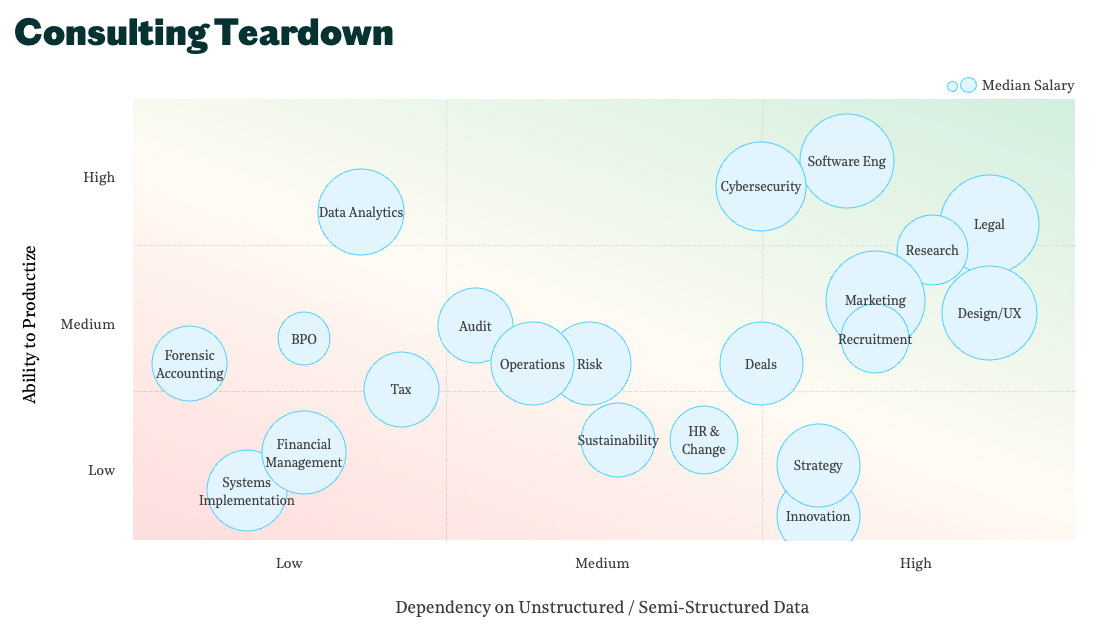

So which services are ripe for disruption? To explore this, I did what any self-respecting ex-consultant would do, and came up with a framework, assessing traditional consulting capabilities3 across three dimensions:

Dependency on Unstructured Data: The extent to which a service can be disrupted hinges on its dependency on unstructured/semi-structured data (text, audio, image, code, logs).

Ability to ‘Productize’ the Service: An undeniably fluffy criteria, but an important one nonetheless. How possible is it that the service can be neatly packaged into an AI product.

Cost of the Alternative: The propensity for AI to disrupt hinges on the price tag of human smarts. All else being equal, services with higher median salaries offer greater economic incentives for AI adoption.

1. Dependency on Unstructured Data

The degree to which the core workflow of a given service is reliant on unstructured data is a critical vector in assessing its disruption potential. Why? Because Foundation Models, which I wrote about here (*shameless plug*) are trained on broad data from the web, which is primarily unstructured in the form of text, video, images etc. Unlike traditional AI which excelled in predictive analytics within the confines of a database, FMs are adept at learning from and adapting to the messy reality of human communication and creation.

Although all services, by their very nature, involve some form of unstructured data, the extent to which it saturates the core workflow of the service provider varies. Take, for example, the realm of financial management - the core workflow is primarily centered on analyzing financial statements, transaction data and forecasts (all structured). On the other hand, a legal professional’s workflow is steeped in contracts and briefs (unstructured). Innovation with AI feels more evolutionary in the former and revolutionary in the latter.

2. Ability to ‘Productize’ the Service

Service providers (McKinsey et al.) often peddle their expertise with a smorgasbord of capabilities, industries and overused parlance that few people actually know the meaning of (shout-out to all the digital transformation teams out there!). But companies don’t hire consultants because they identify as being in the Retail or Real Estate sector. To borrow from Clay Christensen - companies hire products and services to get a specific “job” done.

So what ‘jobs’ are service providers hired for?

Specialist skills: “we don’t have the technical/professional expertise in house”

Bandwidth at a variable cost: “we need extra horsepower”

Objective insight: “we need an independent pair of eyes”

Support during a transition: “we need guidance during a period of change”

Network: “we don’t have the relationships with the right people”

Seal of approval: “we need validation from a trusted brand name”

At first blush, some of these jobs seem more productizable than others. Let’s say you hire one of the Big 4 to carry out a risk assessment. The product you’re buying is an objective pair of eyes and stamp of approval, signaling to stakeholders that you’re compliant with regulation. This implies a level of trust and reputation which AI, on its own, currently lacks. On the other hand, when companies hire a software engineer or a security operations analyst, the product they’re buying is generally a technical skill, which has a higher likelihood of market acceptance when delivered by AI.

It’s also worth considering why AI has been an almost instant productivity driver for software engineering. Two key reasons stand out: first, the workflow is conducive to a text-based, linear interface; second, a substantial portion of the field's knowledge is publicly accessible. We can use these as additional criteria for productizability. Some services are inherently non-linear and complex in nature. Take strategy or innovation consulting for instance. They thrive on the dynamic, often unpredictable dance of frequent, iterative collaboration with the client’s executive team, making it a tough service to package as AI.

3. Cost of the Alternative

The economics of disruption aren’t just about what's technically feasible; but equally what's financially viable. The median salary for a given service skill (reflected in the bubble size on the chart) is an indicator of its market value—reflecting not just the demand for the skill but the costliness of its human provision. Herein my friends, lies a compelling case for AI-driven alternatives. Services that command a premium human price tag are the domains where the financial impetus to switch to AI is strongest.

Startup Opportunities

Startups in this market have crystallized around two distinct business models - those selling to service providers and those targeting in-house teams.

The former has some unique challenges, the primary one stemming from the infamous billable hour model upon which most service providers are built. Charging clients based on units of time incentives elongated engagements to maximize revenue. Efficiency tooling, like AI, is therefore the enemy. Early success stories, like EvenUp, overcame this challenge by focusing on a segment of professional service providers that are incentivized to be efficient - personal injury lawyers that operate on a contingency fee basis, rather than traditional billable hours.

It’s certainly possible that we’ll see a shift away from the billable hour model in the coming years with two strong tailwinds at play:

Client expectations around efficiency rise as they become increasingly exposed to LLMs

One heavy-hitter service provider sticks their neck out and pioneers a move away from the billable hour. Other firms scramble to follow suit. As they say, you don’t want to be the last girl on the dance floor!

In reality, this change won’t happen overnight, particularly given the conservative nature of many professional service providers.

For startups pitching to in-house teams, the allure of AI tooling is inherently more compelling. Many enterprise teams have sizable budgets for consultants so are primed for solutions that promise enhanced productivity without the proportional increase in costs. Responsiv’s pithy slogan “save your outside counsel budget for when you actually need it” encapsulates this dual promise of cost-savings and instant service access that bypasses traditional lead times involved in dealing with service providers.

Emergent Characteristics

Although we’re in the early innings of this market, there are some emergent company traits that, on the margin, could provide a competitive advantage:

Agent-Led (not assisted) Workflows: When we consider the automation continuum — from human-led, to copilot, to agent-led — the latter is where I’m most excited. Co-pilots are a natural extension of existing workflows. And whilst they serve as a necessary bridge for us to build trust in AI systems, they inherently favor incumbents. If startups instead build for the workflow they anticipate will exist in 5 years time, they can nicely counter-position against their incumbents. Consider software development: if you believe in 5 years time, the status quo will be AI agents doing 80-90% of the work with developers signing-off, then optimizing a product for latency and developer in the loop (à la GitHub Copilot) no longer makes sense as the north star. Grit embodies this approach.

Narrow Focus (Skill-as-a-Service): Reflecting on my earlier point, companies hire service providers to get a specific job done. Consider an e-commerce company aiming to forecast demand for specific SKUs in the upcoming year. The skill that they require is that of forecasting. It’s not that they need a data analyst, it’s just that traditionally, data analysts were the means of accessing that skill. I’m interested in startups that are building best-in-class products for the lowest-level unit of work - a skill. A nod to Nixtla who are doing just that.

Founders with Deep Workflow Knowledge: I know what you’re thinking. A VC, talking about the importance of founder-market-fit, well I never! I’ll admit this is by no means a novel thought, and holds true across SaaS more broadly, but I do think its importance is amplified for companies trying to automate services - codifying knowledge requires more than just a passing acquaintance of the problem. The team over at Trullion demonstrate this idea - they have the accounting DNA required to automate critical workflows like revenue recognition and lease accounting.

Pricing Intelligence

The question of how these services should be priced, once packaged as AI, is worth spending some time on.

Regardless of how these products are monetized, the vendors’ costs scale on the basis of usage - that is, the costs associated with pinging GPT-4 (or its alternative) every time a user interacts with the product. This dynamic might incentivize vendors toward a usage-based model themselves to ensure they’re covered against a massive unexpected OpenAI bill.

CJ Gustafson & Kyle Poyar wrote a great piece on the topic of pricing AI products. They highlight Intercom’s approach to pricing its AI customer support agent, Fin, charging $0.99 per successful AI resolution - an interesting early example of an outcomes-based pricing model:

Their model is grounded in usage but tied directly to customer value. Customers only pay if the case is resolved.

It’s easily comparable to the alternative. A human-assisted support interaction costs more than $0.99. Customers can hire AI to achieve higher throughput at a lower cost.

As AI quality improves, a higher percentage of customers cases will be resolved so expansion is embedded into the model.

This pricing model isn’t without it’s challenges though. Predictable costs matter to customers and it can be tough to agree SLAs around the outcome - for example, in Fin’s case, what is deemed a successful AI resolution? Nevertheless, Intercom’s pricing of Fin provides an interesting template for other services→AI startups.

How Much Service Remains?

As this category evolves, a question I’ve been considering is what blend of AI-powered product and human delivered service is optimal, both from a business fundamentals and a valuation multiple perspective.

Services revenue often gets a bad rap in VC land. The skepticism isn’t without its reasons; services lack the operating leverage to scale efficiently and in the case of implementation services, a number too large generally indicates fundamental product issues.

History reminds us though, that not all services revenue is created equal. The interplay between a standalone service and a relating product can be a powerful one. Take CrowdStrike as an example: it began its journey as a services business specializing in incident response. The real value of the service lay in its ability to meet the urgent and critical needs of clients in the aftermath of a breach. It was this initial service offering however, that smoothly paved the way for a shift in customer focus towards seeking preventative solutions, in turn, bolstering the adoption of CrowdStrike's products.

I’ve already started to see similar hybrid models emerge at the intersection of AI software x services and I’m excited to see how this evolves. It feels like there should be a natural flywheel present whereby learnings from the delivery of the service can be embedded as efficiencies in future iterations of the AI product.

We’re at the beginning (emphasize beginning) of a transition away from software that merely augments all of our jobs-to-be-done, to AI that quite literally does the job itself.

As Aaron Levie recently pointed out, the growth curve of cloud can instruct how we think about the timeframe over which AI will be doing the job itself.

With the advent of AWS in 2006, it was clear to many (or at least those of us that weren’t still learning long division at the time) that cloud would be the future, and the headache of managing your own servers, a thing of the past. Yet ~18 years later, despite its size, the cloud market is still growing rapidly. This lag reflects the messy change management required to move services into the cloud.

Today, we're experiencing a moment akin to the early days of cloud - inspiring but nascent.

Great article! Really helped me to prepare for a C-Level meeting next week to implement ai services and change the way of thinking about AI!